According to Sabre’s booking insights, Chinese tourists are back with a vengeance on the global tourism stage, with a 392% surge in outbound travel booked from mainland China for 2024, compared to the previous year.

When you consider that, pre-pandemic, travellers from China made 155 million international trips, collectively spending to the tune of $245 billion, it’s little wonder that the world has been waiting for China to re-enter the global tourism market in a significant way.

However, with China slower to ease travel restrictions in comparison to other countries, even after the re-opening of borders, it hasn’t been a quick comeback. The major rebound of outbound Chinese travel that some expected in 2023 didn’t occur. That picture is rapidly changing in 2024, and what is clear from Sabre’s analysis of industry data (which looks at travel booked from mainland China as of March 31, 2024) is there is a huge appetite among Chinese travelers for global travel.

While outbound travel hasn’t rebounded to pre-pandemic levels, bookings for travel to key parts of the world during typical peak travel dates are seeing particularly strong demand. Bookings made at the end of January before the 2024 Chinese New Year break for travel from mainland China to countries in the Asia Pacific region, for example, were at 106% of 2019 levels.

Key findings include:

- Travel originating from mainland China has increased by a whopping 392% overall globally for 2024, with some destinations seeing surges of more than 2,000%;

- Chinese travelers are taking advantage of reciprocal visa-free agreements with countries around the world, but they aren’t limiting where they travel;

- Airfare prices are down, making travel more affordable for Chinese travelers; Fastest growing routes globally for Chinese travelers in 2024 include Macao, Australia, Japan, Russia, and Bangladesh.

- Chinese travelers are once again embracing Business Class travel, and demand for Premium Economy travel is increasing;

- Outbound airline capacity is up by more than 3000% on some routes as airlines look to meet demand.

Outbound Travel is back with a vengeance

Sabre’s industry booking data analysis shows that the amount of travel originating in mainland China, either already travelled or booked to travel during 2024 (up to 31 March 2024) has increased significantly compared to travel booked at the same point by 2023, soaring by 392% overall.

Outbound travel to all global regions has markedly increased across the year, according to Sabre’s analysis, which looks at travel booked as of March 31 2024. Notably, Chinese travelers are booking in advance for the whole year, showing strong confidence in the travel landscape. Bookings for November and December are significantly up across regions, recording more than 1000% year-on-year for all regions, and notably, more than 2000% for those months for travel to Europe and the Middle East.

For travel to other countries in Asia Pacific (APAC) from China, travelers are planning their trips well in advance, with booking numbers showing large increases, when compared to 2023, for the whole year. October, when the Golden Week holiday period will fall, is recording the largest year-on-year increase in bookings at 1347%.

Outbound travel from China to the Europe and Middle East region (EMEA) peaked in the first quarter of the year, in January with a 676% increase. Again, there are increases throughout the whole year, with a significant year-on-year boost in December.

For the Americas, travel to North America in the first quarter recorded the second highest year-on-year growth, after APAC, at 336%, and travel to Latin America is also increasing throughout the year, with the most significant booking increases for the final quarter of 2024.

New favourites and old favourites Re-Visited

Chinese travellers are renowned for being high spenders when they travel, spending an average of $1,000 a day during their trips. During the nine years up to 2023, disposable income per capita roughly doubled in China, potentially meaning more money to spend on travel. Considering Chinese travelers’ huge collective spending power, several countries around the world have launched initiatives in a bid to be their destination of choice.

Many countries globally have a strategy to attract these high-spending tourists. For example, South Africa, Kenya and Tanzania have launched marketing strategies to attract more Chinese travellers, as have Thailand, Indonesia, France and Saudi Arabia.

So, who is winning Chinese travellers over?

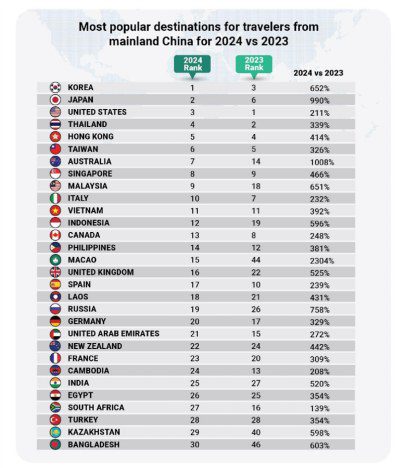

While Chinese outbound travel is significantly increasing overall, there have been destination changes in terms of the most popular routes, when comparing 2023 to 2024, and then looking at the percentage increase in travel booked to each destination.

The top 10 most popular destinations for outbound Chinese travelers are similar in 2024 compared to 2023. However, Australia and Malaysia have moved into the top 10, with Australia moving up seven places, and Malaysia moving from 18th to ninth, while Canada and Spain dropped out. Korea and Japan rose in the rankings to take first and second place respectively, pushing down the US and Thailand.

In the top 30, there has been more movement when compared to 2023. Travel from mainland China to Macao, which is popular as a gambling hub, is also up significantly from 44th place to 15th. Meanwhile, Britain has moved from 22nd to 16th, and Kazakhstan is up from 40th to 29th, with many tourists drawn to its winter sports activities. Bangladesh is also seeing an increase to 30th place from 46th, which may be due to corporate and visiting family travel, and the launch of new routes.

In Asia Pacific, the countries with the biggest increase are Australia and Japan, with Australia moving from 8th to 6th place in the region, and Japan from 5th to 2nd. Australia is aiming to be top of mind for Chinese travelers. Japan has two cities in the top 10 when looking at a city perspective, while the cities seeing the biggest travel booking increases are Macao and Osaka.

Capacity is up…

Airlines are increasing capacity to meet demand. International capacity originating from China increased by 280% year over year in the first quarter of the year, with the largest increases coming from key hubs like Beijing, Shenzhen and Chengdu which saw capacity increase by 400%, 560% and 3200% respectively. These hubs also saw inbound capacity increase significantly by 400%, 560% and 3300%.

… and fares are down

As capacity is increasing and supply and demand are achieving greater equilibrium, fares for routes from mainland China are priced lower across the board when compared to 2023, making travel more affordable for Chinese travellers. For quarter one 2024 travel, the difference was up to -73% and -71% on key routes, with the most significant decreases in fare cost being from Shanghai to Seoul, and Shanghai to Tokyo.

Lower fare prices are seen across most of 2024 and, as bookings are made for 2025, we’re also seeing the trend for lower fares continue into the New Year.

Embracing global travel again

While 2023 was the year of re-opening for China, Sabre’s research shows 2024 is the year Chinese travellers are really embracing global travel again in significant numbers. What is important now is that the travel industry ensures it can deeply understand what travellers from China want, where they want to go, how they want to get there, and the experiences they want to have when they reach their destination.

Those who really make the time and investment to understand and deliver these needs will be the ones who win the hearts, minds, and spending power of Chinese travellers in 2024, and into the future.